The aftermath of a storm can be overwhelming, emotionally and financially. That’s what our insurance attorneys are here for.

Storm damage leaves behind a trail of destruction and uncertainty for homeowners and businesses alike. The insurance attorneys at Stormlex Law Group have helped thousands of policyholders work through their claims and recover their damages. From fallen trees to water damage, a storm can leave properties in disarray, requiring temporary mitigation of damages or prompt restoration to prevent further deterioration.

Especially in Texas, you often have to deal with the complexities of insurance claims, facing challenges such as navigating intricate policy details, delayed payouts, or flat-out having your claim denied. However, by understanding the claims process and partnering with reputable contractors, you can expedite the restoration process and your insurance coverage.

Contractors play a critical role in efficiently restoring properties post-storm damage. Stormlex Law Group is sharing insights from our insurance lawyers:

- How to navigate insurance claims

- Importance of swift property repairs post-storm

- The role contractors play in restoration

- Insurance attorney tips for selecting reputable contractors

- 5 Steps for streamlined property restoration

Insurance Claims Key Strategies from an Insurance Attorney

We have been there before and understand that dealing with insurance claims after a storm is the last thing you want to go through. However, understanding some key strategies about insurance claims can help streamline the process and ensure you receive fair compensation for your damages.

When faced with complex insurance claims and bad faith from your insurance provider, it’s important to document everything related to your insurance claim meticulously. Keep records of all communication with your insurance company, including emails, letters, and phone calls.

Additionally, maintain detailed records of any expenses incurred as a result of the storm damage, such as temporary lodging or emergency repairs. These records can serve as crucial evidence to support your case and maximize your compensation when the insurance company is acting in bad faith.

Furthermore, be proactive in understanding your insurance policy and coverage. Many property owners are surprised to discover gaps or limitations in their coverage when filing a claim. Review your policy carefully and ensure you fully understand your rights and entitlements. Additionally, be aware of any deadlines or requirements outlined in your policy for filing a claim to avoid any potential delays or complications.

By following these key strategies you can navigate the insurance claims process with confidence and maximize your chances of a successful outcome.

Stormlex Tip: We have a short video that explains what your responsibilities are as a property owner:

Insurance Attorney Shares Vital Steps to Address Roof Damage

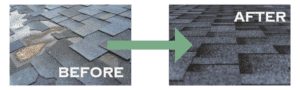

Roof damage is one of the most common issues property owners face after a storm, yet it’s often overlooked until it becomes a more significant problem.

Here are some vital steps to take after a storm, whether it is hail damage, wind damage or water damage, to ensure your roof is protected.

First and foremost, conduct a thorough inspection of your roof as soon as it’s safe to do so. Look for any signs of damage, such as missing or damaged shingles, cracks, or leaks. Pay close attention to areas where different roofing materials meet, as these areas are particularly vulnerable to damage.

If you notice any signs of damage, don’t hesitate to take action. Prompt repairs can prevent further deterioration and minimize the risk of additional damage to your property. Contact a reputable roofing contractor to assess the damage and provide recommendations for repairs or replacement.

Finally, be proactive in maintaining your roof to prevent future damage. Regular inspections and maintenance can help identify potential issues early on and address them before they escalate into more significant problems. Consider scheduling annual roof inspections with a roofer in your city to ensure your roof remains in optimal condition year-round.

By following these steps and working with a reputable roofing contractor, you can address roof damage promptly and effectively, minimizing the impact on your property and maximizing its longevity.

Stormlex Tip: Watch our video explaining what to look for when acquiring an insurance policy to avoid rejected claims in case of roof damage here.

Insurance Attorney Tips for How to Select a Reputable Contractor

Choosing the right contractor is crucial when it comes to restoring your property after storm damage.

A reputable and experienced contractor can make all the difference in the efficiency and quality of the restoration process. However, with so many options available, selecting the right contractor can be a daunting task. Here are a handful of tips from an insurance lawyer to help you make an informed decision:

- Do Your Research: Take the time to research potential contractors thoroughly. Look for contractors who specialize in storm damage restoration and have experience working with your type of property. Check their website for previous work completed and scroll their online reviews to gauge their reputation and reliability.

- Verify Credentials: Before hiring a contractor, ensure they are properly licensed, insured, and bonded. This not only protects you as the property owner but also ensures that the contractor meets the necessary requirements to perform the work safely and effectively.

- Get Multiple Quotes: Don’t settle for the first contractor you come across. Instead, obtain multiple quotes from different contractors to compare pricing, services, and timelines. Be wary of contractors who provide significantly lower quotes than their competitors, as this could be a red flag of subpar workmanship or hidden costs.

- Ask About Warranties: Inquire about the warranties offered by the contractor for their workmanship and materials. A reputable contractor should stand behind their work and offer warranties to provide peace of mind for their clients.

- Communication is Key: Choose a contractor who communicates openly and transparently throughout the restoration process. They should be readily available to answer any questions or concerns you may have and provide regular updates on the progress of the work.

By following these easy tips and selecting a reputable contractor, you can ensure a smooth and successful property restoration process, minimizing stress and maximizing results.

The Restoration Process: Practical Steps from an Insurance Attorney

Efficiency is key when it comes to restoring your property after storm damage. By following some practical steps, you can streamline the restoration process and minimize downtime.

Here are two essential tips for the restoration process:

- Develop a Detailed Restoration Plan: Work with your contractor to develop a detailed restoration plan outlining the scope of work, timelines, milestones, and budget considerations. Having a clear plan in place will help ensure that everyone is on the same page and minimize any potential delays or misunderstandings.

- Communicate Effectively: Maintain open and transparent communication with your contractor throughout the restoration process. Regularly communicate your expectations, concerns, and any changes to the scope of work to avoid misunderstandings and ensure that the project stays on track.

5 Steps for a Streamlined Property Restoration from an Insurance Attorney

Navigating the complexities of insurance claims and contractor restoration can be challenging. Here are five of our expert tips for streamlining your restoration planning:

- Prioritize Repairs: Assess the extent of damage and prioritize repairs based on urgency and safety considerations. Address critical issues such as structural damage and water intrusion first before moving on to cosmetic repairs.

- Review Insurance Coverage: Review your insurance policy to understand the coverage limits, deductibles, and exclusions related to storm damage. Clarify any uncertainties with your insurance provider and ensure you’re maximizing your coverage entitlements.

- Plan for Temporary Accommodations: If your home is uninhabitable due to storm damage, make arrangements for temporary accommodations for you and your family. Keep receipts for expenses related to lodging and meals, as these may be covered by your insurance policy. (You can find what you’re covered for in the Additional Living Expenses section of your policy.)

- Communicate with Neighbors: Keep lines of communication open with neighbors, especially if the storm has affected multiple properties in your area. Sharing information and resources can help streamline the recovery process and foster a sense of community support.

- Stay Organized: Maintain a dedicated folder or digital file for all documents related to the restoration process, including insurance paperwork, contractor estimates, receipts, and permits. Staying organized will help you track progress, manage expenses, and facilitate smoother communication with all involved parties.

Join the Stormlex Alliance: a newsletter dedicated to educating you on insurance policy terms, tips for navigating the claims process, and weather-related prevention tips for your home or commercial property in Texas.

We throw in a weekly Star Wars meme for your entertainment and laughter, too! Who said we can’t have fun in your inbox?

If you reside in San Antonio, Dallas, Austin or another Texas city, this newsletter is a must-subscribe to reach your optimal Jedi master level of your insurance policy and your rights for a maximized claim payout!

Featured Photo by Zohair Mirza on Unsplash